All Categories

Featured

Table of Contents

- – World-Class Investment Platforms For Accredite...

- – Unparalleled Exclusive Investment Platforms Fo...

- – All-In-One Accredited Investor Alternative In...

- – Unparalleled Accredited Investor Wealth-build...

- – Accredited Investor Crowdfunding Opportunities

- – Specialist Accredited Investor Opportunities...

These investors are presumed to have the economic sophistication and experience required to evaluate and spend in high-risk investment opportunities inaccessible to non-accredited retail financiers. In April 2023, Congressman Mike Flooding presented H.R.

World-Class Investment Platforms For Accredited Investors for Accredited Investor Opportunities

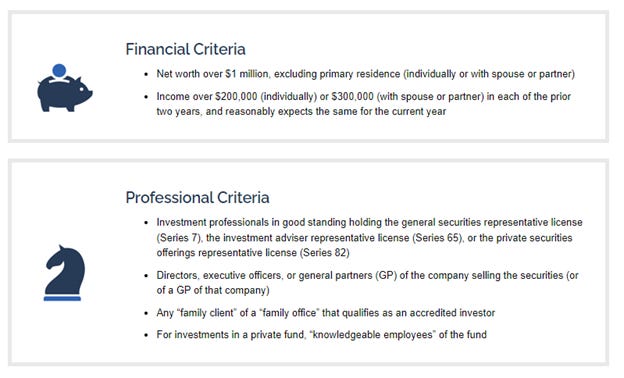

For now, currently must financiers should the term's existing definition. There is no official process or government certification to become an accredited capitalist, an individual might self-certify as a recognized financier under current guidelines if they earned even more than $200,000 (or $300,000 with a spouse) in each of the past 2 years and anticipate the exact same for the present year.

People with an energetic Collection 7, 65, or 82 permit are likewise considered to be recognized investors. Entities such as companies, collaborations, and depends on can likewise attain accredited capitalist condition if their investments are valued at over $5 million. As recognized investors, individuals or entities may take part in private investments that are not registered with the SEC.

Unparalleled Exclusive Investment Platforms For Accredited Investors for Accredited Investors

Personal Equity (PE) funds have revealed remarkable development in current years, seemingly undeterred by macroeconomic obstacles. PE firms pool funding from recognized and institutional capitalists to obtain managing rate of interests in fully grown personal companies.

Along with funding, angel capitalists bring their professional networks, support, and competence to the startups they back, with the expectation of venture capital-like returns if business removes. According to the Center for Venture Research, the typical angel investment quantity in 2022 was about $350,000, with capitalists receiving an average equity risk of over 9%.

That stated, the arrival of online exclusive credit scores platforms and niche sponsors has made the asset class obtainable to specific certified capitalists. Today, financiers with as low as $500 to invest can make the most of asset-based personal credit history chances, which provide IRRs of as much as 12%. Despite the rise of shopping, physical grocery stores still make up over 80% of grocery store sales in the United States, making themand specifically the property they run out oflucrative investments for accredited financiers.

All-In-One Accredited Investor Alternative Investment Deals

In contrast, unanchored strip centers and neighborhood centers, the following 2 most heavily transacted kinds of realty, tape-recorded $2.6 billion and $1.7 billion in purchases, specifically, over the exact same duration. However what are grocery store store-anchored centers? Country strip shopping centers, outlet shopping centers, and various other retail centers that feature a major supermarket as the place's primary tenant generally drop under this group, although shopping malls with encased walkways do not.

Certified capitalists can invest in these spaces by partnering with actual estate private equity (REPE) funds. Minimum financial investments normally begin at $50,000, while overall (levered) returns vary from 12% to 18%.

Over the last years, art has gained ordinary yearly returns of 14%, trouncing the S&P 500's 10.15%. The market for art is likewise increasing. In 2022, the global art market expanded by 3% to $67.8 billion. By the end of the decade, this figure is expected to approach $100 billion.

Unparalleled Accredited Investor Wealth-building Opportunities for Accredited Investors

Financiers can currently have varied private art funds or purchase art on a fractional basis. These alternatives come with financial investment minimums of $10,000 and supply internet annualized returns of over 12%.

An accredited capitalist is an individual or entity that is permitted to purchase protections that are not signed up with the Securities and Exchange Payment (SEC). To be a certified capitalist, an individual or entity needs to fulfill particular earnings and total assets standards. It takes money to make cash, and accredited financiers have much more chances to do so than non-accredited financiers.

Recognized investors are able to spend cash directly right into the rewarding globe of personal equity, exclusive placements, hedge funds, financial backing, and equity crowdfunding. The demands of who can and who can not be a certified investorand can take component in these opportunitiesare figured out by the SEC. There is a common misconception that a "procedure" exists for a private to come to be a recognized investor.

Accredited Investor Crowdfunding Opportunities

The problem of verifying an individual is a certified capitalist drops on the financial investment lorry instead than the financier. Pros of being a recognized capitalist consist of access to unique and restricted investments, high returns, and enhanced diversification. Disadvantages of being a certified capitalist consist of high threat, high minimum investment amounts, high charges, and illiquidity of the financial investments.

Policy 501 of Law D of the Securities Act of 1933 (Reg. D) gives the interpretation for a certified financier. Basically, the SEC defines a recognized financier through the confines of revenue and total assets in two ways: A natural person with revenue going beyond $200,000 in each of the two most current years or joint earnings with a spouse going beyond $300,000 for those years and an affordable expectation of the very same revenue degree in the present year.

Approximately 14.8% of American Households certified as Accredited Investors, and those homes regulated approximately $109.5 trillion in wide range in 2023. Measured by the SCF, that was around 78.7% of all exclusive riches in America. Regulation 501 likewise has provisions for companies, partnerships, philanthropic companies, and trust funds in enhancement to company supervisors, equity owners, and banks.

Specialist Accredited Investor Opportunities for High-Yield Investments

The SEC can include accreditations and designations going forward to be included along with motivating the public to send propositions for various other certificates, classifications, or credentials to be thought about. venture capital for accredited investors. Staff members who are thought about "well-informed workers" of a personal fund are currently likewise taken into consideration to be accredited investors in relation to that fund

Individuals that base their credentials on annual earnings will likely require to submit tax obligation returns, W-2 kinds, and other papers that indicate wages. Approved investor designations likewise exist in various other nations and have similar needs.

In the EU and Norway, for instance, there are three tests to identify if a person is an accredited financier. The initial is a qualitative examination, an assessment of the individual's proficiency, expertise, and experience to determine that they can making their own financial investment decisions. The second is a quantitative examination where the person needs to fulfill 2 of the adhering to criteria: Has performed deals of considerable size on the pertinent market at an ordinary regularity of 10 per quarter over the previous four quartersHas a monetary portfolio surpassing EUR 500,000 Functions or has actually worked in the economic sector for at the very least one year Lastly, the customer has to state in written kind that they intend to be treated as a specialist customer and the company they desire to collaborate with should notify of the defenses they could shed.

Table of Contents

- – World-Class Investment Platforms For Accredite...

- – Unparalleled Exclusive Investment Platforms Fo...

- – All-In-One Accredited Investor Alternative In...

- – Unparalleled Accredited Investor Wealth-build...

- – Accredited Investor Crowdfunding Opportunities

- – Specialist Accredited Investor Opportunities...

Latest Posts

Tax Lien Investing

What Is Tax Lien Certificates Investing

Property Tax Lien Investing

More

Latest Posts

Tax Lien Investing

What Is Tax Lien Certificates Investing

Property Tax Lien Investing