All Categories

Featured

Table of Contents

- – Favored Investment Platforms For Accredited In...

- – World-Class Accredited Investor Crowdfunding O...

- – Accredited Investor Investment Returns

- – Reputable Exclusive Investment Platforms For ...

- – Unparalleled Accredited Investor Alternative...

- – Favored Private Equity For Accredited Investors

- – Best-In-Class Exclusive Investment Platforms...

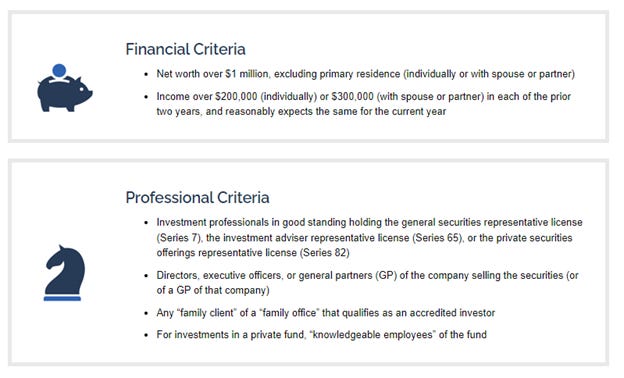

The laws for recognized investors vary amongst jurisdictions. In the U.S, the definition of an approved investor is presented by the SEC in Rule 501 of Policy D. To be a recognized financier, a person needs to have an annual earnings surpassing $200,000 ($300,000 for joint income) for the last 2 years with the assumption of gaining the same or a higher income in the current year.

A recognized investor should have a net worth surpassing $1 million, either separately or jointly with a partner. This quantity can not consist of a primary residence. The SEC likewise takes into consideration candidates to be approved financiers if they are basic companions, executive officers, or supervisors of a firm that is providing non listed safeties.

Favored Investment Platforms For Accredited Investors

If an entity is composed of equity owners who are recognized investors, the entity itself is a certified financier. Nonetheless, a company can not be created with the single function of buying particular protections - accredited investor investment networks. A person can certify as an approved investor by showing adequate education and learning or job experience in the monetary industry

Individuals that intend to be accredited capitalists do not use to the SEC for the designation. Rather, it is the obligation of the firm supplying a private positioning to see to it that every one of those come close to are recognized investors. Individuals or parties who intend to be recognized investors can come close to the issuer of the unregistered safeties.

Expect there is a private whose revenue was $150,000 for the last three years. They reported a main home worth of $1 million (with a home loan of $200,000), a vehicle worth $100,000 (with an outstanding car loan of $50,000), a 401(k) account with $500,000, and an interest-bearing account with $450,000.

Web worth is computed as possessions minus responsibilities. This individual's net well worth is precisely $1 million. This involves a computation of their assets (apart from their key home) of $1,050,000 ($100,000 + $500,000 + $450,000) much less an auto loan amounting to $50,000. Considering that they meet the total assets demand, they certify to be a recognized capitalist.

World-Class Accredited Investor Crowdfunding Opportunities for Accredited Investor Opportunities

There are a couple of less common certifications, such as handling a trust fund with greater than $5 million in properties. Under federal safeties laws, only those who are certified investors may get involved in certain securities offerings. These might consist of shares in personal placements, structured products, and personal equity or hedge funds, to name a few.

The regulators desire to be particular that individuals in these highly dangerous and complicated financial investments can fend for themselves and evaluate the dangers in the lack of government security. The accredited capitalist regulations are designed to protect possible capitalists with restricted financial expertise from adventures and losses they might be unwell furnished to withstand.

Accredited financiers fulfill qualifications and expert criteria to gain access to unique financial investment opportunities. Designated by the U.S. Securities and Exchange Compensation (SEC), they get entrance to high-return options such as hedge funds, venture funding, and exclusive equity. These financial investments bypass complete SEC enrollment however carry higher dangers. Certified capitalists must meet income and total assets requirements, unlike non-accredited individuals, and can invest without constraints.

Accredited Investor Investment Returns

Some essential modifications made in 2020 by the SEC include:. Consisting of the Series 7 Collection 65, and Collection 82 licenses or other credentials that show financial competence. This modification identifies that these entity types are frequently used for making investments. This change recognizes the proficiency that these staff members create.

These amendments broaden the accredited investor pool by roughly 64 million Americans. This bigger accessibility offers extra possibilities for financiers, however also increases possible threats as less financially sophisticated, capitalists can participate.

One significant benefit is the opportunity to purchase placements and hedge funds. These investment options are unique to accredited financiers and organizations that certify as an accredited, per SEC laws. Personal positionings allow business to secure funds without navigating the IPO procedure and governing paperwork needed for offerings. This gives certified capitalists the chance to invest in emerging companies at a phase before they consider going public.

Reputable Exclusive Investment Platforms For Accredited Investors

They are considered as financial investments and are accessible only, to certified customers. In enhancement to known companies, certified financiers can pick to buy start-ups and promising endeavors. This provides them income tax return and the chance to enter at an earlier phase and potentially reap incentives if the company flourishes.

For capitalists open to the dangers involved, backing start-ups can lead to gains (accredited investor real estate investment networks). A lot of today's tech firms such as Facebook, Uber and Airbnb originated as early-stage startups supported by approved angel investors. Sophisticated financiers have the chance to explore investment alternatives that might produce extra profits than what public markets provide

Unparalleled Accredited Investor Alternative Investment Deals

Although returns are not assured, diversification and portfolio improvement options are increased for financiers. By diversifying their portfolios with these broadened financial investment methods approved financiers can enhance their strategies and potentially attain premium long-term returns with appropriate threat administration. Skilled capitalists frequently run into financial investment options that may not be conveniently available to the basic financier.

Financial investment options and securities supplied to accredited capitalists generally involve higher threats. Personal equity, endeavor resources and bush funds usually concentrate on spending in assets that lug threat but can be liquidated easily for the opportunity of higher returns on those risky investments. Researching before spending is important these in scenarios.

Lock up durations avoid investors from withdrawing funds for even more months and years on end. Investors may battle to accurately value private assets.

Favored Private Equity For Accredited Investors

This adjustment might prolong certified financier condition to a variety of people. Updating the revenue and asset criteria for rising cost of living to ensure they mirror modifications as time progresses. The present limits have actually stayed static considering that 1982. Permitting companions in fully commited connections to combine their resources for common qualification as recognized investors.

Enabling people with particular professional accreditations, such as Collection 7 or CFA, to qualify as recognized capitalists. Creating added requirements such as evidence of financial literacy or effectively finishing an approved financier test.

On the other hand, it could likewise result in skilled capitalists presuming extreme risks that might not be suitable for them. Existing accredited investors may encounter boosted competition for the ideal investment chances if the swimming pool grows.

Best-In-Class Exclusive Investment Platforms For Accredited Investors with High-Yield Investments

Those who are presently considered certified capitalists have to stay upgraded on any kind of changes to the criteria and regulations. Companies seeking recognized capitalists should stay vigilant about these updates to guarantee they are bring in the right target market of investors.

Table of Contents

- – Favored Investment Platforms For Accredited In...

- – World-Class Accredited Investor Crowdfunding O...

- – Accredited Investor Investment Returns

- – Reputable Exclusive Investment Platforms For ...

- – Unparalleled Accredited Investor Alternative...

- – Favored Private Equity For Accredited Investors

- – Best-In-Class Exclusive Investment Platforms...

Latest Posts

Tax Lien Investing

What Is Tax Lien Certificates Investing

Property Tax Lien Investing

More

Latest Posts

Tax Lien Investing

What Is Tax Lien Certificates Investing

Property Tax Lien Investing