All Categories

Featured

Table of Contents

One of the easiest examples of the benefit of being a recognized investor is being able to spend in hedge funds. Hedge funds are mainly only obtainable to accredited capitalists due to the fact that they need high minimal investment quantities and can have higher connected dangers yet their returns can be phenomenal.

There are additionally disadvantages to being an accredited investor that connect to the investments themselves. Most financial investments that require a specific to be a recognized capitalist included high danger (venture capital for accredited investors). The techniques employed by lots of funds featured a greater danger in order to achieve the goal of defeating the market

Just depositing a couple of hundred or a few thousand bucks into a financial investment will refrain. Approved capitalists will have to dedicate to a couple of hundred thousand or a couple of million dollars to take part in financial investments implied for certified investors. If your financial investment goes south, this is a whole lot of cash to shed.

All-In-One Accredited Investor Investment Funds

Performance costs can range in between 15% to 20%. An additional con to being an accredited capitalist is the capability to access your financial investment capital.

Being a recognized capitalist comes with a whole lot of illiquidity. They can also ask to assess your: Bank and various other account statementsCredit reportW-2 or other incomes statementsTax returnsCredentials issued by the Financial Industry Regulatory Authority (FINRA), if any These can help a company establish both your financial qualifications and your sophistication as a financier, both of which can affect your condition as an accredited investor.

An investment lorry, such as a fund, would have to determine that you qualify as a recognized capitalist. The benefits of being an accredited financier consist of accessibility to unique investment opportunities not readily available to non-accredited capitalists, high returns, and raised diversity in your portfolio.

Unmatched Accredited Investor Opportunities

In specific areas, non-accredited capitalists additionally can rescission. What this indicates is that if an investor chooses they intend to draw out their cash early, they can declare they were a non-accredited capitalist during and get their cash back. Nevertheless, it's never a good concept to give falsified records, such as fake tax obligation returns or monetary declarations to an investment car simply to spend, and this can bring lawful trouble for you down the line - accredited investor investment networks.

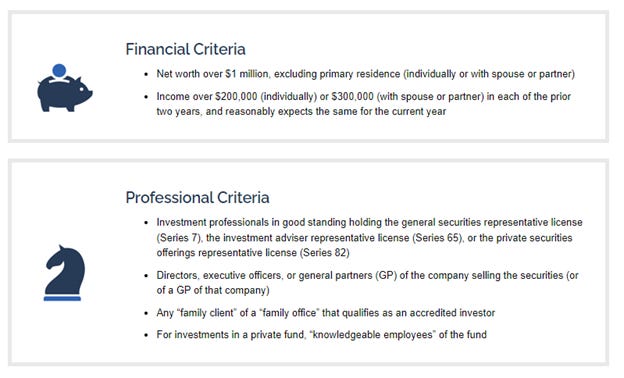

That being stated, each deal or each fund may have its own restrictions and caps on investment amounts that they will certainly accept from a financier. Certified investors are those that fulfill particular demands relating to revenue, qualifications, or net well worth. They are generally well-off individuals. Certified capitalists have the chance to invest in non-registered financial investments supplied by business like personal equity funds, hedge funds, angel investments, endeavor capital firms, and others.

High-Quality Accredited Investor Opportunities

Over the previous a number of years, the recognized capitalist interpretation has actually been slammed on the basis that its sole focus on an asset/income examination has unfairly omitted all but the most affluent individuals from rewarding investment opportunities. In reaction, the SEC started considering methods to broaden this meaning. After a considerable remark period, the SEC took on these amendments as a way both to catch individuals that have trustworthy, different signs of financial refinement and to improve particular out-of-date parts of the meaning.

The SEC's main problem in its regulation of unregistered securities offerings is the security of those capitalists that do not have a sufficient level of economic elegance. This problem does not put on experienced workers since, by the nature of their placement, they have enough experience and access to monetary details to make educated investment decisions.

The determining variable is whether a non-executive staff member really joins the exclusive investment company's investments, which should be determined on a case-by-case basis. The addition of educated workers to the recognized capitalist interpretation will additionally allow more employees to purchase their company without the personal investment firm risking its very own condition as an accredited investor.

In-Demand Passive Income For Accredited Investors

Before the modifications, some exclusive investment firm ran the risk of shedding their accredited financier condition if they permitted their workers to purchase the business's offerings. Under the amended interpretation, a majority of personal financial investment company staff members will certainly currently be eligible to invest. This not only develops an extra source of funding for the private investment firm, yet also additional aligns the rate of interests of the worker with their company.

Currently, only people holding specific broker or monetary advisor licenses ("Series 7, Series 65, and Collection 82") certify under the definition, however the amendments grant the SEC the capacity to include additional certifications, designations, or qualifications in the future. Specific kinds of entities have likewise been included to the definition.

When the interpretation was last upgraded in 1989, LLCs were fairly unusual and were not consisted of as a qualified entity. Under the modifications, an LLC is taken into consideration an approved capitalist when (i) it has at least $5,000,000 in possessions and (ii) it has actually not been created only for the details function of getting the safety and securities offered.

Certain family workplaces and their customers have actually been added to the interpretation. A "family office" is an entity that is developed by a family members to manage its possessions and offer for its future. To ensure that these entities are covered by the meaning, the changes state that a family workplace will certainly now qualify as an approved investor when it (i) handles at the very least $5,000,000 in assets, (ii) has actually not been created especially for the objective of getting the offered safety and securities, and (iii) is guided by an individual that has the financial refinement to assess the benefits and dangers of the offering.

Accredited Investor Alternative Asset Investments

The SEC requested remarks regarding whether the monetary thresholds for the revenue and asset tests in the definition must be adjusted. These thresholds have actually remained in area given that 1982 and have not been changed to make up inflation or various other elements that have actually altered in the interfering 38 years. The SEC ultimately determined to leave the asset and revenue thresholds the same for currently.

Please allow us know if we can be useful. To read the initial alert, please click on this link.

Latest Posts

Tax Lien Investing

What Is Tax Lien Certificates Investing

Property Tax Lien Investing